How to Use IW Retirement Planner

Retirement planning is an empowering process, regardless of age. The process of planning not only fosters a sense of financial security but also a roadmap for financial well-being.

IW Retirement Planner streamlines retirement planning by bringing together two widely-used methods: straight-line forecasting, which projects future financial needs, and industry-standard Monte Carlo stress testing, which evaluates risk by simulating different market conditions. This approach combines the strengths of both techniques, offering a powerful, free tool that helps you feel confident in your plan and the decisions you make.

Investment Income Buckets

- Cash & Equivalents are readily available funds, including Savings, CDs, Money Market, and Treasury Bills. You can set a maximum value for this bucket using the Invest Excess Cash field. Any amount above this limit is automatically invested in Taxable Investments at year-end.

- Taxable Investments include stocks, bonds, and mutual funds held outside retirement accounts. You can specify the bond allocation and cost basis (the purchase price of investments).

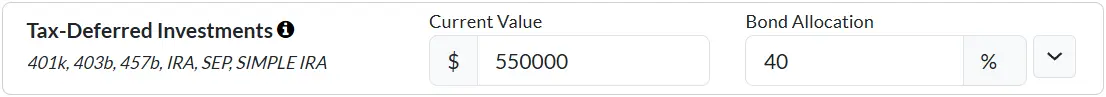

- Tax-Deferred Investments are retirement accounts that allow you to defer federal income taxes until funds are withdrawn. Common examples include 401(k), 403(b), 457(b), IRA, SEP, and SIMPLE IRA accounts. You can specify the bond allocation for this bucket.

- Tax-Free Investments are retirement accounts where taxes are paid on contributions up front, so future growth and withdrawals are generally tax-free. You can specify the bond allocation for this bucket. If your 401(k), 403(b), 457(b), IRA, or SIMPLE IRA includes a Roth component, include that amount in this bucket. IncomeWize does not currently have an HSA income bucket, but HSA funds can be included in the Tax-Free Investments bucket.

Tax-Deferred Income Bucket

Tax-Deferred Income Bucket

Non-Investment Income Buckets

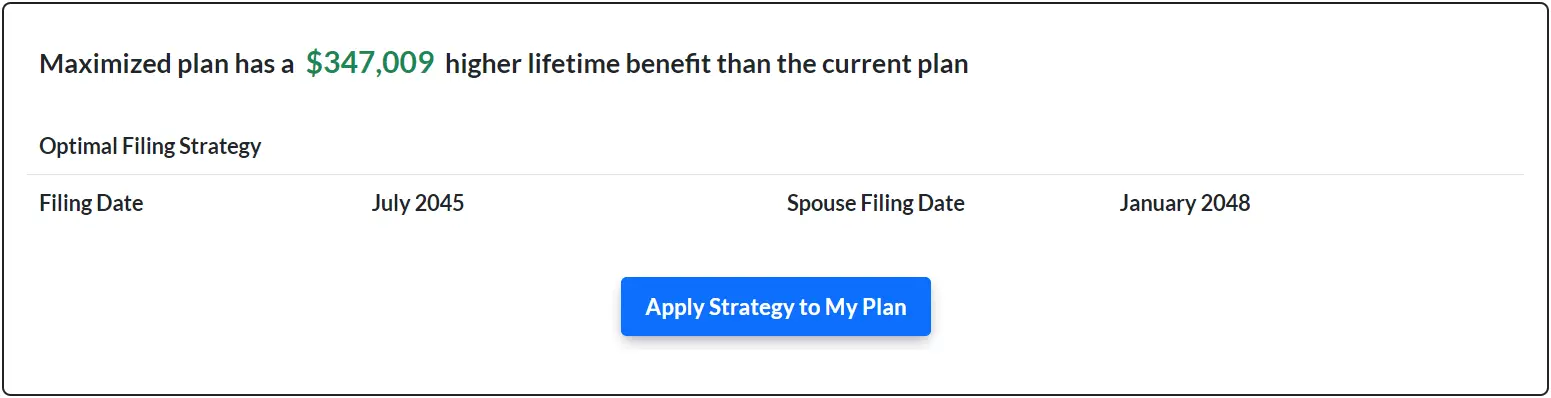

- Social Security is a federal program providing monthly retirement income based on your earnings history. Enter your estimated monthly benefit at Full Retirement Age (in today's dollars) and the intended starting date. Refer to the FAQ for guidance on getting the most accurate FRA benefits estimate on SSA.gov. Spousal and survivor benefits are estimated automatically when applicable. If you are already receiving Social Security benefits, enter your current before-tax benefit amount and the date your benefits began.

- Pensions provide a fixed monthly retirement income, typically funded by a former employer. Enter your expected benefit starting amount and the percentage payable to a surviving spouse, if applicable. For pensions with cost-of-living adjustments (COLAs), enable automatic increases and set the COLA rate in Assumptions. Lump sum distributions should be entered in Other Income. If you are already receiving pension benefits, enter your current before-tax benefit amount and select Already Receiving for the start date.

- Employment is post-retirement work, either part-time or full-time. Enter your expected annual income, annual raise, and employment starting and ending dates. Part-time work can be included to supplement retirement income or to explore early retirement options. You can also include full-time employment to reflect continued spousal work. If there is a gap between your retirement date and your spouse's, be sure to account for any employment during that period. For example, if you plan to retire in 2040 and your spouse in 2045, make sure to include your spouse's employment from 2040 to 2045. If you are already employed (and you or your spouse are currently retired), enter your current annual income and select Already Employed for the starting date.

Social Security Income Bucket

Social Security Income Bucket

Extra Savings

Income bucket savings automatically grow each year during your pre-retirement phase. You can also boost your savings by selecting the Extra Savings option to make additional contributions. Enter the after-tax amount you plan to set aside. Extra Expenses

In addition to your regular monthly expenses, you may have other one-time or recurring needs, such as paying off debt, taking a family vacation, or contributing to a child’s education or wedding. To include these, click the Extra Expenses button and enter any additional post-retirement expenses into your plan. Do not include Healthcare-related expenses in this section. Please use the Healthcare Costs estimator to account for medical expenses. Other Income

Beyond your income buckets, you can include one-time or recurring income events such as an inheritance, lump-sum pension distributions, or royalties. To add these, click the Other Income button and enter both pre- and post-retirement income amounts. The values should reflect after-tax amounts and are not adjusted for inflation.

Income bucket savings automatically grow each year during your pre-retirement phase. You can also boost your savings by selecting the Extra Savings option to make additional contributions. Enter the after-tax amount you plan to set aside. Extra Expenses

In addition to your regular monthly expenses, you may have other one-time or recurring needs, such as paying off debt, taking a family vacation, or contributing to a child’s education or wedding. To include these, click the Extra Expenses button and enter any additional post-retirement expenses into your plan. Do not include Healthcare-related expenses in this section. Please use the Healthcare Costs estimator to account for medical expenses. Other Income

Beyond your income buckets, you can include one-time or recurring income events such as an inheritance, lump-sum pension distributions, or royalties. To add these, click the Other Income button and enter both pre- and post-retirement income amounts. The values should reflect after-tax amounts and are not adjusted for inflation.